by Debra Baker

It is well established that the higher the risk or reward of the legal need, the less price sensitivity. The more routine a matter, the greater the expectation for discounts, flat fees or a clear value proposition around efficiency and results.

Taking this link between perceived business impact and price a step further leads to a tangible measurement tool: the corporate budget. Although most interviewed base legal budgets on historical spend, at least one General Counsel identified a direct relationship between how the company budgets and how it perceives the value of legal services.

This General Counsel typically uses outside counsel for one of two things: issues associated with doing deals and those associated with day-to-day operational issues.

Each of the company’s deals has its own budget and associated legal costs are billed against the budget for each specific deal. In contrast, day-to-day legal costs are part of a separate legal department budget. While both are necessary, one cost is tied to the overall business strategy while the other is a cost of doing business.

This isn’t to say fee sensitivity doesn’t exist in both categories. Excessive costs due to an acquisition lowers the overall profit margin, while fees tied to day-to-day matters reflect on her department and ultimately her ability to manage costs. But the value to the company is clearly different. One provides the company an opportunity to generate revenue while the other is overhead. Hence the former is perceived as more valuable.

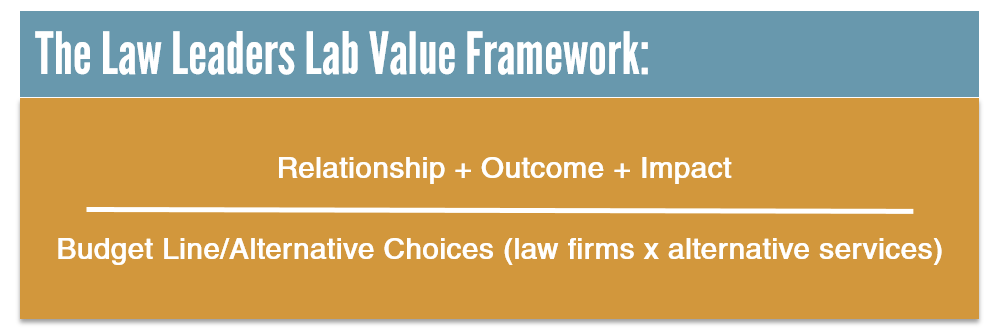

As companies become more sophisticated in how they plan for legal costs, we believe this correlation between value and bottom-line impact will become more tangible. As a starting point, we’ve identified three buckets of impact-based value:

1) Investments: Legal matters connected to business strategies that will result in revenue generation or growth of market share. On the transactional side, this might include mergers and acquisitions or licensing deals. On the litigation side, this could be planned litigation by companies as a business strategy to protect important interests such as intellectual property.

2) Risk Mitigation: These are expense items where the goal is to avoid or minimize exposure. Risk mitigation can be proactive, such as compliance programs, or reactive, such as unforeseen litigation.

3) Cost of Doing Business: Legal activities and guidance associated with running the day-to-day operations of a business, such as employment matters, contracts, leasing, or “nuisance” litigation.

The takeaway? Looking at legal matters from the perspective of business impact provides insight into the mindset of the client. Price will continue to be driven by a cost-benefit analysis. That said, matters that have the opportunity to generate revenue share will be less price sensitive. At the same time, day-to-day matters will invariably be price sensitive and come with an expectation of certain business efficiencies than say a subject matter expert who can make an unwanted piece of litigation go away quickly.

Law Leaders Lab is committed to helping lawyer rethinking the way lawyers create, deliver and communicate value to clients. We invite you to join the conversation and engage with the law firm leaders of tomorrow at www.lawleaderslab.com